What Happens to Your Company’s Flood Insurance if the Flood Zone Changes?

Coverage can be here today and gone tomorrow!

Sea levels are rising; rainfall is increasing; and flood zones are changing.

Do you know what effect the latter has on your company’s flood insurance?

We buy property insurance on a particular property for a particular policy term and we expect that, at least until the end of the policy term, coverage will remain in force on that property. There is some cynical behavior by the insurance industry with flood insurance however that makes that scenario not so certain anymore.

In the commercial market there is are private flood insurance insurers operating in addition to the coverage provided by FEMA. The private insurers supplement the low limits offered by FEMA, or replace FEMA altogether in the low hazard flood zones.

How Flood Zones Work

Virtually every property in the country is in a specific flood zone established by FEMA. The zones are:

—– High hazard: A, V

—– Moderate hazard: B, shaded X

—– Minimal hazard: C, X

The commercial flood insurance market operates generally like this:

In high hazard areas (A, V) they will provide coverage only excess of FEMA’s maximum limit which is either $500,000 or $250,000 depending on the type of building.

In low hazard areas (C, X) they will provide primary coverage with a deductible such as $50,000 or $100,000.

In moderate hazard areas (B, shaded X) insurers will do one or the other of these approaches depending on their risk appetite.

Given that setup, now here is the insurance problem: the coverage provided by the insurer is subject to the zone remaining the same during the policy period. A fair approach would be for the insurance to remain in effect regardless of a zone change, subject to re-rating or re-evaluation at renewal, but that is not how the industry is operating (with possible exceptions of course).

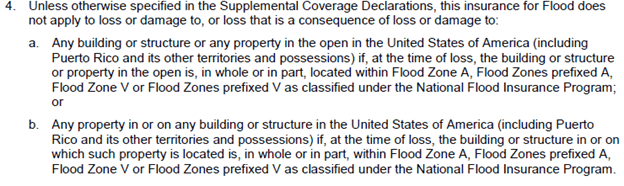

Here is an example of the typical policy language in question:

In this example the policy covers properties in any zone except A or V. But the zone that applies is the one in effect “at the time of loss,” not the one in effect at the policy effective date! And, as mentioned, FEMA is in the process of, and will constantly be in the process of, revising flood zone designations to reflect increasing flood exposures. Other coverage arrangements can be different; for example the deductible can jump from $50,000 to $500,000 in the event of the zone change.

So, bottom line: the risk of a flood zone change rests with the insured, not the insurance company. The insurer gets to protect its own balance sheet, while the little old insured is left vulnerable!

What To Do About the Coverage Uncertainty

Property owners should know what zones their properties are in at the beginning of the policy year —- and all during the policy year. There are companies who offer flood zone determinations – along with continuous zone change monitoring. In our work with clients we monitor the zone for a 30- year period via a third party service provider. If we find a zone change which triggers a coverage gap, we will have to take evasive action.

Beyond Insurance

Risk management is not just about insurance. It also involves the areas of loss prevention and loss mitigation. With respect to flood, these could include elevation of the property (most feasible with new construction), barriers, wet-proofing and more. Some resources can be accessed here:

mitigation for commercial buildings

mitigation when you cannot elevate

Frank Licata 617-718-5901 – [email protected]

(c ) Licata Risk & Insurance Advisors, Inc., 2019

May 06, 2019