Life Science Lawsuits – Learning from the Ordeal

— Principles applicable to all companies:

1. Why the suit? Maybe we can prevent the next!

2. Insurance lessons from the cases

We’ll use life science companies as the subject group because they are the canary in the coal mine– the first to be targeted and hit.

This is true in D&O (Directors & Officers Liability) because the company’s financial prospects are volatile and investors can be and often are overly optimistic. There can also be overkill by the company in describing the product success and/or prospects.

In Products/Professional Liability, the firms are on the cutting edge of life saving solutions, but the solutions aren’t yet proven; unexpected negative results occur, which lead to injury and litigation.

Here we look at four cases in each of the two categories. Some of the cases have insurance lessons in them. They are educational for all types of companies.

Directors & Officers Liability (D&O)

Directors & Officers Liability (D&O)

D&O claims primarily involve errors, omissions, wrongful statements or conflict of interest in the management of the company. The claimant can be an investor and/or stockholder in the company.

Many of the D&O claims are based on sudden drops in the value of the company (if privately held) or the stock price (called “stock drop” cases). Sometimes the drops follow equally dramatic rises in the stock based on information provided by the company.

Hill v. MacroGenics, Inc. (class action)

The company makes a breast cancer drug. In early 2019 they announced results of a clinical study touting a “24% risk reduction” in survival rates compared to a competing drug. Another announcement referred to “positive results from a pivotal… phase 3 study.” The stock soared over 130% on these press releases.

Later in May the American Society of Clinical Oncologists (ASCO) published their analysis of the study results with a very different view on how to measure the extent of the benefit, saying it amounted to only a “0.9 month improvement” in the life of the patient. That was the beginning of a continual series of drops in the stock price.

The case is pending. But it seems the most generous way you can put it is to say the company got far too cute in the way they expressed the outcome, as it seems obvious that ASCO’s method of presenting it would be much more meaningful to doctors, patients and stockholders. Straining to find a measure that produces a big number is only going to work very temporarily.

While there are market pressures pushing to create a positive buzz, from a D&O standpoint absolute accuracy and clarity is the best practice – the one that will prevent the litigation.

SEC v. Mylan

This case is about how a company should disclose risk factors in its public documents. The case is regulatory, not stock price per se; it would have been a stock-drop case if not for Mylan’s size and diversification. It is a lesson, though, for companies not in Mylan’s league for whom the matter would have been a much more serious crisis.

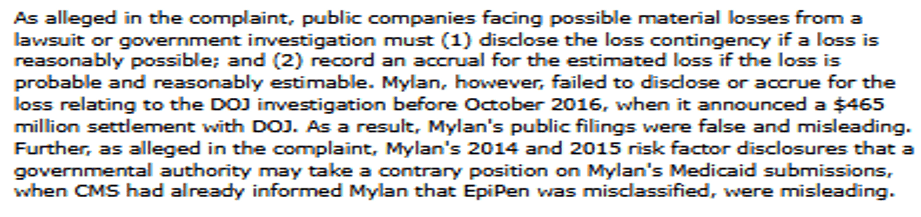

The SEC claimed Mylan made misleading statements in its annual reports. The subject is Mylan’s EpiPen product for treatment of allergic reactions. At the time of production of the SEC reports, Mylan had been involved in litigation with the federal government over whether Mylan overcharged Medicaid for the product.

Prior to Mylan’s settlement with Medicaid, Mylan stated in their reports that “a governmental authority may take a contrary position on Mylan’s Medicaid submissions.” (emphasis added). Mylan did eventually settle with Medicaid for $465M.

Here are the core points of the SEC case:

- Mylan’s disclosure sounded like a generic, routine risk factor that would be in the report even if there was no specific action. In reality, at the time they made these perfunctory sounding statements Medicaid had already advised Mylan they were misclassified.

- Mylan’s financial statements were misleading because they did not make an accrual for the expected financial loss.

The SEC put it this way in announcing the $30M settlement of their (SEC’s) action:

Mylan’s actions, if done by smaller a smaller, less diversified company, causing a loss of this size, would be a D&O bomb, given a “hidden” $465M obligation.

Multiple Shareholders v. Nobilis Health

This is a series of separate stock-drop claims against the company alleging misleading financial statements, and several rounds of financial restatements where the company corrects prior errors.

Downward adjustments to previously filed financials or to previously announced projections always have the possibility of leading to trouble. Nobilis is not a large company and one of the complaints alleges the company overstated one year’s annual revenue by $36 million; in fact several years of financials were restated by the company. The obvious take-away is to bend over backwards with financial accuracy; but the main point is insurance related.

The case involves D&O insurance and the “related acts” provisions in all D&O policies.

There may be several different insurers in a company’s D&O program over a span of several years. Insurer A handles a claim in year 1. In year 2 Insurer B, writes the D&O and now a new claim is reported in year 2. The question is which insurer is responsible for the new claim. If it is “related” to the original claim it will be sent back to Insurer A.

As you can expect, Insurer A wants to say it is not related (and the claim goes to B), while Insurer B wants to say it is related, so the claim goes back to Insurer A. It depends on the definitions of “related acts” in the two policies.

Great American Insurance Co was Nobilis’ insurer in year 1 in which the “Hall” claim was submitted. Later, after that policy had expired, two more stock-drop cases were submitted, “Schott” and “Cappelli.” Great American denied the cases were related and so declined to take the claims. It’s possible, though not stated in the case, that Nobilis had not renewed its D&O and so there was no other insurer in play to pick up the claim. So Nobilis had to sue Great American. In Nobilis Health v. Great American the debate was settled with the judge determining Great American had to defend.

Keep “Related Acts” in mind when dealing with D&O coverage in the midst of claim activity:

- Be very careful changing insurers, especially is there is claim activity;

- If you do change insurers, compare the definitions in the expiring policy and in the replacement to make sure they are identical (unlikely), or that you understand the ramifications of the differences.

Rosalind Franklin Medical University v. Lexington Insurance Co.

Rosalind was conducting a clinical trial of a breast cancer vaccine. At a mid-point in the study, Rosalind decided to discontinue it for various reasons that amounted to “medical judgment.” The trial subjects sued on the basis that they were harmed by the discontinuance of the vaccine which they believed were having a beneficial effect on them. Rosalind carried a healthcare liability policy with Lexington which covered the direct claims. (Incidentally, this is a novel type of claim which you might want to consider in drafting informed consent forms!).

There were also indirect (non-medical) claims filed, which Rosalind submitted to its D&O carrier. This is a common occurrence for which you should be careful to have secure coverage: an underlying claim for professional services (covered by the professional liability), followed by a subsequent round of claims which are management related rather than directly professional. These are subsequent, indirect, claims by, for example, stakeholders concerned about reputational damage, or donors to the university or to the specific study itself. These subsequent claims should be covered by the D&O.

Rosalind’s D&O was written by Landmark American Insurance Company. Landmark denied coverage, and their denial was upheld by the court. The fatal flaw in the policy was very harsh language of a “medical or professional malpractice” exclusion.

In D&O we need to pay particular to the prefatory language introducing the core of an exclusion. We might agree the core malpractice claim should not be covered by the D&O – it would be covered under a different policy designed for that situation. But, we do want coverage in the D&O for claims arising out of the core claim. In this case, the preface read: “The insurer shall not be liable…in connection with any claim…based upon or attributable to [any medical or professional malpractice…]”. Additional prefatory wording to be avoided in an exclusion is “arising out of.” What we need instead is the less harsh intro “for” : “the insurer shall not be liable for [any medical or professional malpractice…]”. With this preferred language the actual core bodily injury claim is not covered by the D&O, but the management -related follow-on claim is.

In policy interpretation, subtle differences in wording can mean the difference between covered … and bare.

[Since the case name cites Lexington Insurance Company, not Landmark, you may be wondering. Lexington was involved in that they were looking for participation by Landmark in the payment they had made to Rosalind.]

See more on negotiating policy terms.

Products and Professional Liability (PPL)

Products and Professional Liability (PPL)

Life science companies come into contact with the public both in the testing of their products/services (clinical trials, etc.) and when their products/services actually reach the market. They may also interact with other companies in some information or revenue sharing arrangement. Defects or hazards in products or errors in professional services can lead to injury and damages. The claimants can be customers, patients and business associates.

Margaret Engleman v. Ethicon and Johnson & Johnson

This case involves injury allegedly caused by defects in the J&J vaginal mesh product. (Ethicon is a J&J unit). The case went to trial and the plaintiff was awarded $15 million, of which 12.5M were for punitive damages. Because the plaintiff provided voluminous documentation that J&J was aware of many complaints about the product, but kept selling it, this was likely the basis for the punitives.

The case highlights two points:

- Punitive damages — when, where, for what, and whether insurable.

- The concept of fighting vs. settling, and the insurance implications of that.

Punitive damages are designed for the purpose of punishing a party for actions that are against public policy – to deter bad behavior. The 50 states vary in their treatment of punitive damages. The variables by state are: whether they exist as a remedy, whether there are caps on the amount, either absolute dollars or % of compensatory damages, the circumstances that might call for them, and whether they are insurable.

We should always try to negotiate for absence of a punitive damages exclusion in a PPL policy, and even attempt to get a “most favorable venue” clause in the coverage. That clause states that of the applicable venues for the case, the insurer will use the state most favorable to the insured in determining coverage of punitives.

On the fight or settle question, J&J is a good subject because they try to defend their product in court in many instances, rather than settling. Settling can send a mixed message to the market concerning the safety of the product, and you may want to defend. What might your insurer say about that?

Sometimes it feels like there is a conflict of interest between the insured and the insurer. To insurers it’s often a strictly financial decision: legal costs to defend vs. how much less they can settle for. As a life science company with a reputation to uphold, you may view it in a completely opposite way.

You should arrange for language in the policy requiring the insurer to obtain your permission to settle. Be careful about the terms surrounding this issue. If you refuse to give permission, and the ultimate judgment is higher than what it could have been settled for, are you responsible for any of that overage? Often you will be responsible for a portion, expressed as a % of the overage, and that percentage should be as small as possible.

Karidis v. Takeda Pharmaceuticals

This one concerns a Takeda drug for gout that the plaintiff claims caused his heart attack. In fact, in February of 2019, the FDA did require the company to put a black box warning on the drug for cardiovascular risks. The FDA’s description of a black box warning is: “It appears on the prescription drug’s label and is designed to call attention to serious or life-threatening risks.” The warning is literally in a black box on the label.

The plaintiff took the drug in 2016, prior to the warning label being applied, but claims Takeda knew of the problems, and produced evidence including correspondence with the FDA. The plaintiff claims the FDA’s approval of the drug was subject to the company conducting additional trials by a certain date in 2014 even prior to the date the plaintiff started taking the drug. Part of the case is based on Takeda’s failure to conduct the trials by the deadline. There were notices concerning the drug on the FDA website even prior to the black box warning.

Be cognizant that FDA actions involving drugs are available to the public, and warnings to the public by the drug maker in tandem with the FDA actions would be a factor in bringing and defending lawsuits.

Admiral Insurance Co. v. Superior Court, Respondent; A Perfect Match, Real Party in Interest

In this case Admiral Insurance Company petitions the court for an interpretation of the PPL policy it issued to A Perfect Match, a company that arranges egg donors for infertile families. The baby was born with a genetic defect and A Perfect Match was accused in the lawsuit by the family of improper screening of the donor.

The case highlights a very important insurance subject: claim reporting. Admiral denied the claim based on failure to report, and their position was upheld by the court.

Insurance policies have reporting requirements that are triggered at various points, depending on the policy language. When a policy is of the “claims-made” variety (most D&O and Professional policies) this is particularly critical. “Claims-made” policies respond to claims filed (“made”) against the insured during the policy period. At the same time, the policies allow you to report an “incident” or “circumstance” during the policy period with the promise that if it does become an actual claim at a later date, the policy will cover it as though it was made during the policy period. The later policy, the next year, will not cover claims resulting from circumstances you were aware of but did not report. This latter provision is called a “knowledge” clause.

When there are “circumstances” during one policy period, and then the policy expires and renews, the insured must be very careful in how to report.

A Perfect Match made the following mistakes. In year one they received three letters from the plaintiff’s attorney announcing the plaintiffs were planning to file a complaint. A Perfect Match did not report to the insurer in year one. The actual suit appeared in year 2 at which time they did report, but they were then held subject to an exclusion for claims about which they had “knowledge” prior to the policy period.

The combination of circumstances known, and a policy about to expire can be a deadly mix if not handled correctly. How and when to report circumstances, and actual claims, is an art form itself, when dealing with the complexities of policy language combined with the uncertainties of the future development of simple circumstances that haven’t yet ripened into full- blown claims. By no means try that without understanding your policy’s terms and conditions.

Advanced Medical Optics v. Cytosol Labs

Cytosol supplied a salt solution to Advanced Medical Optics (AMO) for AMO’s resale to the medical community for optical uses including eye surgery. AMO started receiving complaints about toxicity from its customers and shortly thereafter Cytosol received a recall notice from the FDA. AMO claimed damages against Cytosol related to the damages suffered by its customers and for its own recall costs.

This case is one with several insurance points to it. Cytosol reported the AMO claim to Chubb, its insurer, and litigation between Chubb and Cytosol ensued, with Chubb coming out with a verdict confirming their denial.

The real issue was the type of insurance Cytosol carried, not the quality of the insurance. Cytosol had purchased from Chubb a Products Liability policy which would have covered Cytosol if (and when) the claims were from claimants who suffered bodily injury. Products Liability covers claims for bodily injury and property damage. As such it won’t cover claims for product recall costs (incurred by Cytosol itself or by its customers), or for claims against the insured made by its customers for loss of profits or market share or for damage to its reputation.

The lesson here can be awareness of the need in some cases for both Product Recall coverage and Manufacturer’s Errors & Omissions in addition to the Products Liability.

To summarize in a big-picture way:

—– Products Liability: covers claims by the persons injured by a defective product, such as a serious reaction to a drug.

—– Products Recall: covers costs of the insured in recalling their own product from the market place, and also related costs such as PR consulting and legal expenses. This may also be structured to cover the recall costs of the insured’s downstream customers as well.

—– Manufacturer’s E&O (Errors & Omissions): covers economic loss by the insured’s customers related to a problem with the insured’s product. For example reputational damage, loss of revenue and market share, and related expenses.

You can see defective products can generate liabilities in various ways, and each of the ways may need its own policy to supply the remedy.

All companies should have an understanding of how these policies work. This is particularly true of life science firms as they are right on the front lines.

(c ) Licata Risk & Insurance Advisors, Inc., 2020

Feb 24, 2020

Receive a free copy of this report

Please enter your contact information and we will email you a copy of this report at no charge.