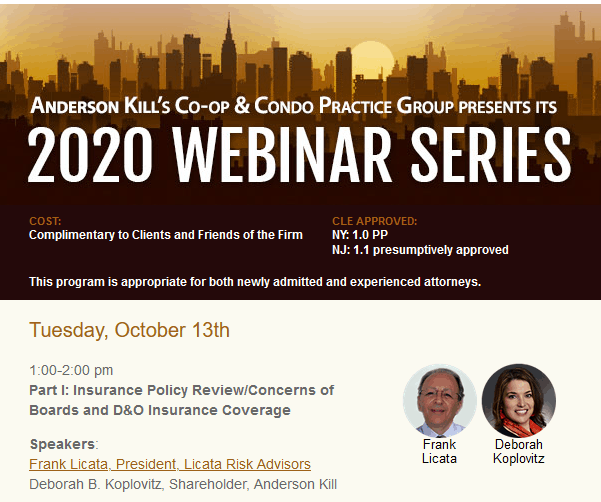

Condo Board Risk & Insurance Concerns – Including D&O Coverage

In conjunction with Anderson Kill

Sorry, this event has been postponed. Please look here for the reschedule date.

Tuesday October 13, 1:00-2:00 pm

Understanding Condo Insurance – for Board Members. Is there a liability exposure from serving on the board?

1. Where does the master insurance leave off – and the unit-owner insurance pick up?

a) are the condo docs written correctly in the first place?

b) the best approach for that allocation

2. Coverage issues and gaps to watch out for: property insurance terms and exclusions; liability insurance terms and exclusions.

3. How much insurance is enough – the art of determining proper limits.

4. D&O insurance for the board. What limit? Don’t buy on price alone – you need to know the policy language.

5. How to advise the unit-owners of the master coverage and how their own insurance interacts, including re the property deductible. Enlisting the broker to establish contact with the unit-owners.

Register

Have a risk manager on your side

The largest companies have entire risk management departments reporting to the CFO. You need risk management too.

(c ) Licata Risk & Insurance Advisors, Inc. 2020

Frank Licata

[email protected]; 617.718.5901

Oct 08, 2020