Some insurers try to gut D&O insurance in a core area!

Directors and Officers: Are You Covered if Sued by Your Investors/Shareholders? (Investors: will your claim be covered?)

With D&O insurance, perhaps the biggest worry of directors and officers is a suit by their investors, who usually are also shareholders. Coverage for this claim is the core value of D&O insurance. Some insurers, though, are trying to get out from covering this through exclusionary language in their policies. (The issue applies to privately-held companies).

The Insured v. Insured Exclusion

All D&O policies have an “insured v. insured” (I v I) exclusion. This prevents coverage for a claim by one insured, say the CEO, against another insured, say the CFO. It also prevents coverage for a claim by the company against its own directors or officers. These are internal disputes for which the insurance was not designed. We are ok with the usual insured v. insured exclusion.

Shareholder claims should be covered

Though the I.v I exclusion does exist, coverage for suits by investors/shareholders should be clear and unimpeded. The usual I v I exclusion does not restrict that coverage except in the rare case that the investor/shareholder is an individual (the investment is not through an entity, an LLC, etc.), and the same individual has obtained a seat on the board. In that case, board service makes him/her an insured, and triggers the exclusion. The individual investor with a board seat should be aware that a suit by that investor against the officers of the company will not be covered by the D&O; a special arrangement may need to be made.

In most cases, though, the investor/shareholder is an entity separate legally from the individual sitting on the board, so coverage is preserved.

The Corrupted Insured v. Insured Exclusion

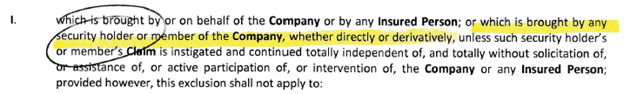

The new twist in D&O is now putting coverage in jeopardy. Several insurers amend their insured v. insured exclusion by adding reference to “security holder.” The exclusion then reads:

As you can see, the introduction of the words “security holder” has the effect of creating a major gap in that it precludes the important coverage we have been discussing for suits by investors. The exception for claims that are “totally independent of , and totally without … assistance of …” an insured has no practical value. It is completely unlikely the investor/shareholder would not have cooperation by a board member (an insured), particularly if that investor entity has negotiated the right to have a person on the board, watching out for its interests.

Awareness of this problem is the key. Not all insurers are using this restrictive language; we need to find the right insurers, and negotiate the language – yes, remember, insurance is negotiable.

Another Gotcha: The Major Shareholder Exclusion

Another similar exclusion being used by some insurers excludes claims by shareholders with more than a specified percentage of ownership or control. This is also a potential major gap in your D&O insurance, one to be avoided at all costs.

As always, you need to know what is buried in the guts of your insurance contract. The bigger issue is one we constantly remind clients of: being passive in any contract negotiation will lead to trouble. Active participation (and enough knowledge of the issues) will ensure liabilities are transferred in a proper way to the right party

Have a risk manager on your side

The largest companies have entire risk management departments reporting to the CFO. You need risk management too.

(c ) Licata Risk & Insurance Advisors, Inc. 2020

Frank Licata

[email protected]; 617.718.5901

Nov 28, 2020