Risk Management Street-Smarts

Most people think insurance is complicated. It is. The bigger subject of Risk Management even more so.

But, like all big issues CEOs, CFOs and GCs deal with, it has to be understood at a high level, broken into parts, and managed through delegation.

These are the components:

- Control Losses

- Manage Contracts

- Manage Insurance Brokers

- Negotiate Insurance Terms

- Know the Psychology of Risk

Street-smarts

Control Losses

This is a core principle. Ignoring this and trying to insure the inevitable losses is a losing strategy.

Loss frequency causes an insurance pricing problem; taken to an extreme, it causes an insurance availability problem. Loss frequency and loss severity causes an insurance availability crisis.

Breakdown exposures into categories and make sure they are being addressed by the parties you designate. For example:

Cyber — your IT department in conjunction with outside security experts

Property/Liability – insurance company loss control inspectors, fire departments

Workers Compensation – OSHA, loss control consultants

Employment – HR department and outside legal advice

Rather than trying to insure your way out of the problem, see why it can be even better to retain some of the losses Embracing High Deductibles Can Be Smart Risk Management

Manage Contracts

Contracts interact with the terms of your insurance.

Parties transfer responsibilities in the following areas:

-

-

- Indemnification

- Insurance requirements

- Limitations and waivers of liability

-

What’s in your contract can void your insurance or subject your insurance to losses you should not assume. On the flip side, you can protect your company and your insurance from claims. You do care about your insurer because claims paid affect your cost starting at the next renewal.

Please see Protect Revenue, Assets, Reputation

Manage Your Insurance Broker

No matter how much you like your broker, understand the broker’s role.

Be savvy in dealing with the insurance world and know every party’s agenda and expertise. Keep the following points in mind:

-

-

- Brokers, like many in business have a conflict of interest. The conflict is between the need to sell and the actual protection in the policy. Insurance is not a commodity – in fact the opposite.

- Brokers, like all in business, want to minimize competition. They engage in market blocking.

- They don’t really know what’s in the guts of the insurance policies they market. That’s not their job!

-

Please see Broker of Record Letter – Should You Sign and How the Insurance Industry Hides and Protects Their Bottom Line

Negotiate Your Insurance

“Negotiate” implies that insurance terms are not take-it-or-leave-it. That is true, and to the extent that is true depends on your size and assertiveness (like any other contract negotiation).

Insurance policies are many pages because they are complicated, sometimes convoluted, and they are written by insurers who are protecting their bottom line.

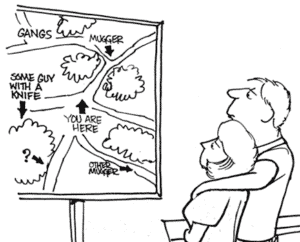

Be street-smart and be aware of that. Buying a policy without knowing what’s in it is like walking down a dark alley drunk with music blasting in your head- phones.

Get more detail on the coverage negotiation process: Improve Coverage

Know When Your Own Mind is Fooling You

This has been studied by many scholars over the years. Being street-smart is knowing when your mind can be playing tricks on you! Follow up on this fascinating subject here, and stop and give a second thought to your original impulse: The Psychology of Risk – Don’t Let it Pervert Your Insurance Choices

Have a risk manager on your side

The largest companies have entire risk management departments reporting to the CFO. You need risk management too.

(c ) Licata Risk & Insurance Advisors, Inc. 2022

Frank Licata

mailto:[email protected]; 617.718.5901

May 07, 2022