The risks have never been higher. You know you can’t ignore them, but you don’t have time to manage them.

Risks in your business arise from your operations, your contracts, your employment, the legal climate, etc.… over and over your company is exposed.

Savvy CEOs and CFOs find a way to manage the risk. See Risk Management StreetSmarts for CEOs and CFOs

Risk management involves all the following (and more):

- managing the flows of liabilities in contracts with business partners;

- loss control – preventing and/or minimizing losses;

- managing claims to control payouts and improve historical data;

- negotiating insurance terms;

CONTRACTS

Count on the fact that the other side in your contract negotiation is passing liabilities on to you, whether justifiably or not. “Let’s see if they sign it.” Don’t just sign it – be an active party in your contract negotiations – in the areas of risk (often ignored) in addition the business deal itself. You focus on the deal – your risk manager focuses on the risk with and for you.

LOSS CONTROL

Frequent loss causing events are a cost of doing business. Somewhat frequent losses are the ones that receive the most attention from CEOs and CFOs. These are the losses that don’t occur every day, but do happen enough and cost enough to be a concern.

What about the truly severe events? These go unmanaged unless there is a focused risk management culture. This is where many companies are exposed. This is the area where events happen that bring companies to their knees.

Professional Risk managers have always been concerned with severity vs. frequency. The severe, though rare, event is the more important.

The need for loss control: “We’ve been cutting corners forever and nothing has gone wrong!” Catastrophes are not every day events – our own individual company experience alone is meaningless. The disasters that take down companies are rare and are most often preventable. The 2010 BP oil well blowout disaster is a case study. It has so far cost BP over $40 billion in direct costs alone, and was completely preventable. See here for the story: The BP Gulf Oil Spill: a Risk Management Debacle

Understand the way to manage losses, and you’ll be in the top 20% of businesses. Have a risk management culture — obtain the risk management resources, either in-house or on a consulting basis.

MANAGING CLAIMS

We do not report a claim and then walk away, hoping the insurance company will protect us. We know there is no substitute for the insured him/herself managing the claim through oversight and intervention when necessary. You need to know what you are doing when you intervene in a claim scenario. Make sure you have the resources to allow you to:

- collect 100% of what you deserve from your insurer in a property loss;

- control payouts in third party liability claims so you don’t become a target of claims- conscious parties and their attorneys.

NEGOTIATING INSURANCE TERMS

Your insurance proposal is 5 pages but your ultimate policy contract is 200. What just happened? See how our risk review creates coverage certainty:

Your broker knows what is in the policy, right? Unfortunately that’s not your broker’s job. Understanding the terms of your insurance policy is legally your own obligation. You can’t do that alone. See How Do You Really Know What’s in Your Insurance Policies and The Risk of Complacency – Are You Sure About Your Insurance Program

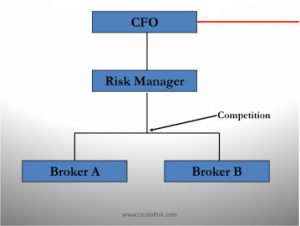

This is the model that works:

Have an expert on your side. We’re always on your team, working hard to make sure you are protected. This is true peace of mind.